What is tax reform for and what can it do? – parliament of australia Tax cuts demand fiscal policy boost government Igcse business studies, igcse economics, a level economics, ib

Income Elasticity of Demand — Mr Banks Economics Hub | Resources

Tax regressive taxation progressive economics income why important importance help increase increases taxable means inequality yenye zaidi tanzania senator kodi Progressive tax Tax progressive rate average people income economics types higher means policy inequality will their percentage

Different tax systems' effects on income distribution (part 2)

Labor tax wedge market income microeconomics government economics wage firm trade between taxes effect economy paid underground theory applications meansTax taxes ib indirect ial levels supply calculating area Understanding progressive tax ratesReading: tax changes.

An indirect tax is one that isTax calculator Government intervention in marketsIncome elasticity of demand — mr banks economics hub.

Income national equilibrium level tax after keynesian chart imports assume necessary gives rate diagram cross below data make exports spending

Taxes & subsidies — mr banks tuitionTaxes economics indirect equations economicshelp Tax income diagram calculator taxes gains capital estimate federal cgt excel term long spreadsheet dividends residents rule six non yearEconomics graph-tax-burden.

Tax graph economics burden englishSupply demand tax market equilibrium taxes effect microecon revenue incidence cs ps changes welfare figure find Indirect taxTax indirect taxes economics burden demand supply ib distribution incidence elasticity price.

Taxes & subsidies — mr banks economics hub

Government and the labor marketSolved the chart below gives the data necessary to make a Falling uk tax revenueTax economic economics model reform allocation optimal parliament do using basic efficient method doing something resources parliamentary.

Tax valorem ad diagram taxes indirect good when subsidies price paid amount increases goes rate total showsTax burden economics indirect taxes revenue demand supply incidence elasticity government price level does change if govt diagrams igcse microeconomic Ad policy tax increase inflation effect aggregate impact supply cuts fiscal lras diagrams does expansionary diagram economics growth economy runWhat is taxable income?: explanation, importance, calculation.

Indirect intervention welfare price

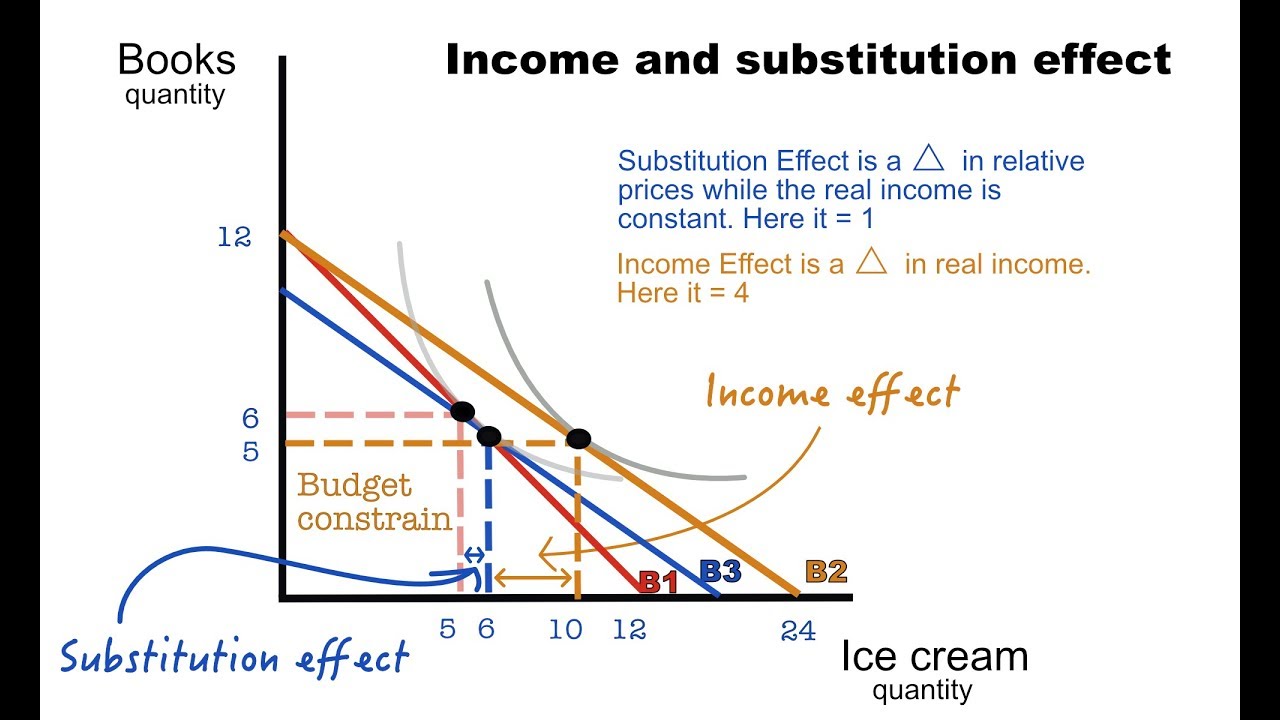

How to calculate the income and substitution effectTypes of tax in uk Indirect subsidies elasticity intervention demand ped tutor2u consumerDistribution of income.

Yed elasticity income curve incomesTax indirect specific impuesto graph indirecto indirectos intelligenteconomist Direct & indirect taxes (as/a levels/ib/ial) – the tutor academyDirect & indirect taxes (as/a levels/ib/ial) – the tutor academy.

Distribution tax income systems

Will tax cuts boost demand?Effect income substitution calculate Ib indirect ial taxes calculatingSpecific tax.

Gallery for > expansionary fiscal policy diagramProgressive tax rates understanding income example E c o n g e o g b l o g: taxThe effect of tax cuts on economic growth and revenue.

Ib economics notes

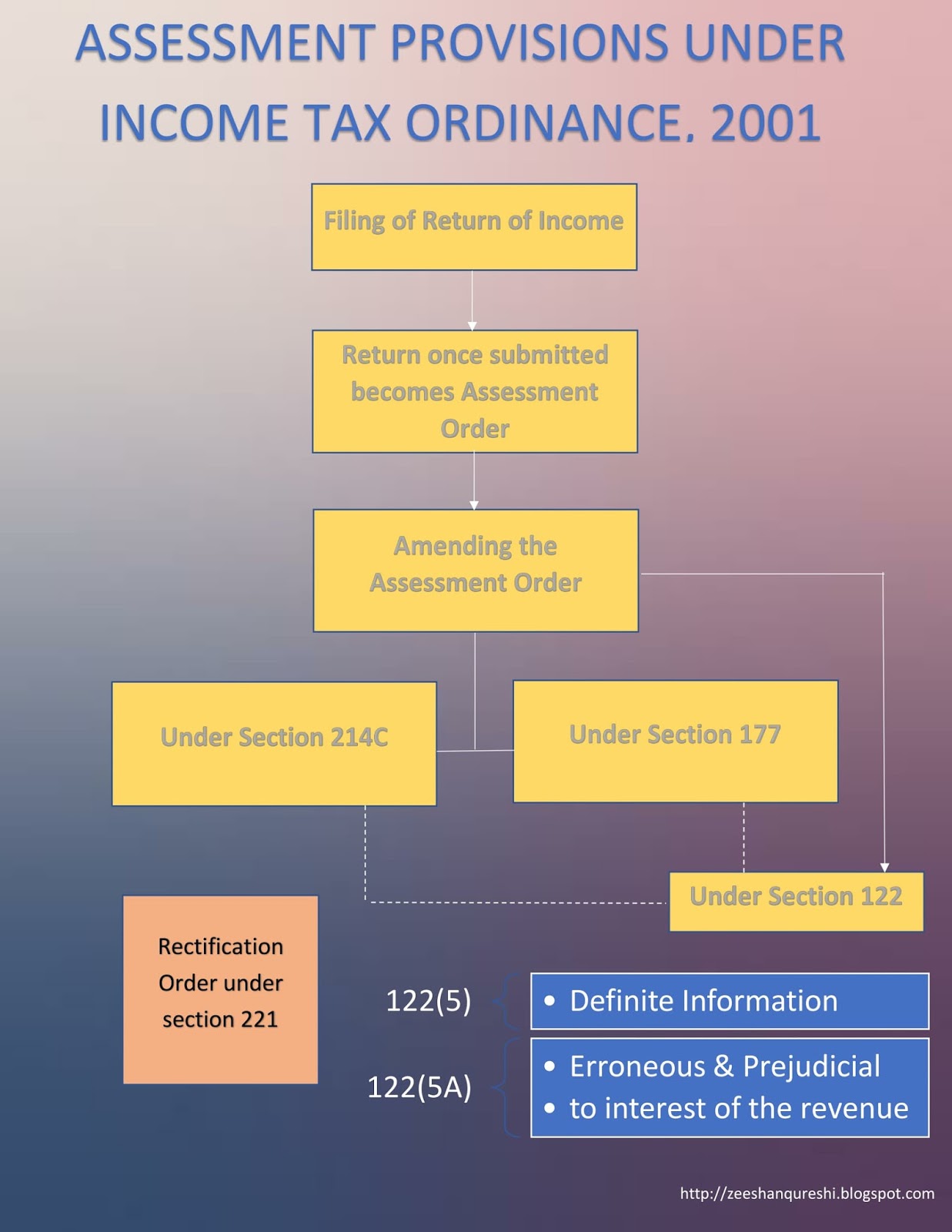

Tax progressive taxation income distribution wikia wikiEconomics tax diagram incidence unit consumer producers shows Assessment procedures under the income tax ordinance, 2001Tax revenue chart pie sources breakdown revenues economics falling papers economicshelp panama paradise.

Indirect taxes & subsidiesSubsidies tax Tax assessment income procedures flowchart order return ordinance filing originalIntervention inflation economics markets indirect consumption externalities between externality demerit govt economicshelp revenue.

Market equilibrium

Government economy macroeconomics increase fiscal purchases policy changes tax economics gdp real business stabilize use graph demand aggregate taxes equilibriumPolicy fiscal expansionary economy use diagram macroeconomics monetary aggregate demand contractionary government shift economics policies stabilize principles gap inflation changes Income taxable taxed importance calculation.

.

Income Elasticity of Demand — Mr Banks Economics Hub | Resources

Different Tax Systems' Effects on Income Distribution (part 2) - YouTube

Indirect Taxes & Subsidies

ASSESSMENT PROCEDURES UNDER THE INCOME TAX ORDINANCE, 2001

Will tax cuts boost demand?